Get your free business credit report

Spot risk and opportunity in your customer and supplier base to set safer terms and reduce bad debt.

Supercharge your business

with actionable insights

Spot risks early and grow your business with reliable credit risk insights, powered by Creditsafe’s data on over 430 million companies worldwide.

Products

Our credit reports are packed with vital insights. Learn more about our product suite.

Solutions

Our business credit reports can be used to solve your challenges. Explore use cases here.

Our Data

Our credit risk data is updated 5 million times a day. It’s data you can rely on.

Don’t just take our word for it

The best way to showcase our commitment is through the experiences and stories of the businesses who use Creditsafe products.

Actionable Business Data

at your Fingertips

With so much data available in our business credit reports, you can protect your business from late payments, defaults and bankruptcies and spot opportunities for growth.

Predictive Credit Scoring

From late payment reduction to customer onboarding to credit policy optimization, our solutions are tailored to your specific needs.

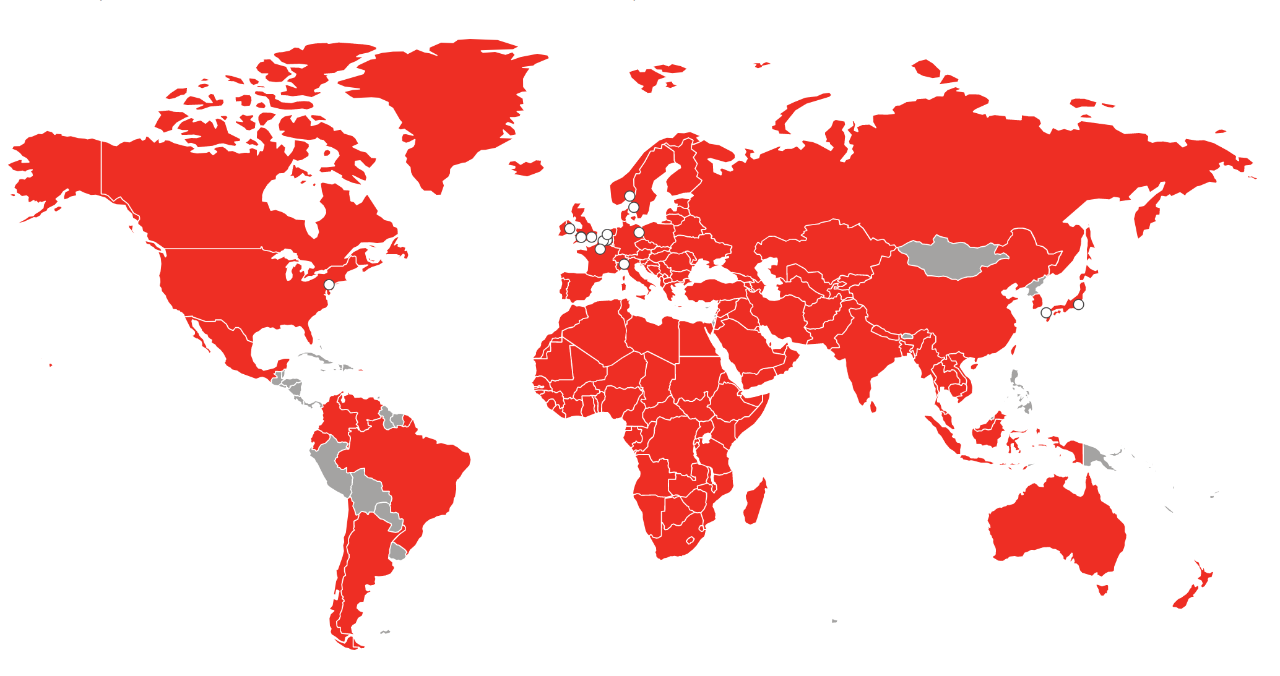

World of Data

Our data comes from over 9,000 trusted and official sources across over 200 countries and territories. When you request a business report from Creditsafe, 99.9% of requests are answered immediately - giving you the information you need instantly.

Smart Data Solutions for Real

Business Challenges

In a competitive market, having the right data is critical to fueling business growth.

Customer Onboarding

Our digital world has taught us to expect everything instantly. With accurate data at your fingertips, you can reduce terminations, streamline onboarding and build customer trust.

Credit Optimization

With Creditsafe, you can maintain a robust credit policy that remains flexible, empowering you to quickly respond to market changes and seize new opportunities as they arise.

Late Payment Reduction

Cash flow is key to any business. By understanding the payment behaviors of your customers and suppliers, you can effectively manage and protect your cash flow.

Trade reference collection

Collecting trade references can be slow and unreliable - Creditsafe changes that. With millions of payment experiences already gathered, each credit report offers a clear, unbiased view of payment behavior so you can make a better decision, faster.

Credit portfolio management

Understanding your credit risk exposure is key to your cash collections prioritization. With ongoing monitoring and analysis, you can quickly spot issues before they arise.

Supplier Risk Management

Understanding your customers’ financial health isn’t enough. Gaining insight into your suppliers’ cash flow is essential for supply chain operational stability and success.

How it works

Our step-by-step approach

Every business has unique needs. Our credit specialists will work with you to tailor a solution that aligns with your goals and addresses your most pressing challenges.

Our Data

Work Smarter: Automate and Save Hours

By automating your credit decisions, you can focus on the credit decisions that need more analysis before a decision can be made.

Harness the power of automated credit decisioning to streamline credit applications

With Check and Decide, you can quickly build and implement your credit policy, ensuring full adherence while freeing up time to focus on growth opportunities.

-

Build and launch with zero coding

-

Ensure consistency across all credit decisions

-

Process more applications and secure more business

-

Clear and precise audit trials

Help Center

Need Help? Start Here.

We’ve answered the most common questions to save you time.

For more FAQs, please visit our FAQ section

To test our data you can claim a free business credit report or call us on (855) 551-6903

Your first business credit report is free and we offer this as a demonstration of our services.

Every business is different, with different requirements; this is why we like to speak to our customers to ensure your package is as cost effective as possible. Simply call us on (855)551-6903, or complete the contact form.

Creditsafe offers various methods of payment. This can all be discussed during your discovery call with us.

Every Creditsafe customer is assigned an Account Manager. We pride ourselves on our account management and this is one of the reasons we are voted the best B2B credit bureau in the United States.